You want to make an impact for your business. But sometimes you’re not quite sure how. You’ve got questions.

The 3 Most Important Factors in Choosing a Customer Feedback Channel

Your customers have the answers. Customer feedback is they key to keeping your customers happy and growing your business. But how do you pry those answers from your customers? How do you glean that gold from your happy and unhappy customers? Well, you have to ask them.

But asking is often the hardest part. When do I ask them? What do I ask? How do I ask them? We’ve got some strong opinions on all of that here at O3, but today we’re going to focus on that last question: how do you ask your for feedback from your customers? Which method is best for asking for customer feedback? Fear not; we asked the hard questions for you and have you covered.

Factors and Channels for Customer Feedback

There are three main factors to consider when deciding how to listen to your customers:

- Response rates

- Ability to continue the conversation

- Audience expectations

You can use those three factors to then compare the different channels available to you. Typical methods for gathering responses from your customer base include:

- Email (linking to a web-based survey)

- Phone calls (either manual or automated)

- SMS (automated text messages)

- Online (on-site or in-app surveys)

- In person

We’ll take a look at each of the three factors and each of the channels available, breaking down which is most effective under each circumstance.

Factor #1: Response Rates

One of the most important criteria to look at when choosing a channel to gather feedback is your desired response rate. Do you want to hear from as many people as you possibly can? Or are you okay getting fewer but potentially more in-depth responses?

There’s an inherent trade-off between response rates and the length of the survey, with response rates quickly dropping off once you get beyond 10 questions. To maximize response rates keep the questions asked to a minimum, but the method you pick also greatly impacts response rates.

Luckily, we can establish some baselines by looking at the average response rates for various methods of customer contact:

The more personal and convenient the channel, the higher the response rate.

In-person surveys are highly effective, but are difficult to pull off when accounting for time and personnel. Email surveys are basically free, but suffer from low response rates because of overcrowded inboxes. And phone calls hover around the middle of the pack, but are time-intensive if done manually and can easily be annoying if automated.

With the response rate figures from above in mind, you can start to ask yourself how many of your customers you need to hear from to be effective. If you are going to survey 100 of your customers, will you be fine if you only hear from 6 of them (via email), or would it be more beneficial to hear from 30 (SMS)? It would be fantastic to hear from over half (57 via in-person surveys), but the man-hours required to do so may be prohibitive, depending on the situation.

Factor #2: Continuing the Conversation

Another important decision factor is the ease with which you can continue the conversation once feedback has been supplied by the customer. If you realize there is some sort of action that could or should be taken after hearing from your customers, does that channel allow you to act on that right away?

Email and online feedback surveys usually require some other method to reach back out, because when the survey’s over, it’s over. But phone calls, text messages, and in-person feedback requests open up a two-way for easy follow-up.

The speed with which you can get back in touch with a customer after they’ve left vital feedback can be the difference between a customer perceiving you to be incredibly responsive and caring or just another faceless corporation gathering data.

Factor #3: Audience Expectations

Finally, you have to consider your audience and how they would expect to be contacted when considering the right channels for customer feedback.

Emails are a given today in both B2B and B2C settings, and online surveys are commonplace as well, and are an easy (if overused) option.

On the other hand, most consumers aren’t going to expect someone to actually stop by their house and ask how things went, but a text message to that customer is often a welcome, easy option for a consumer. Texting is growing in both popularity and demand, and is increasingly attractive especially to younger consumers. But a phone call may be the only viable option in business scenarios where multiple accounts are managed by one person or desk, for example, and require a bit of human introduction to get the right results.

It’s always important to evaluate customer expectations when it comes to communication methods. In some cases you might be restricted just by the availability of data, because it’s tough to send an email or send a text if you don’t have the address or phone number. (However, one interesting fact we’ve discovered with our customers is that, without prompting customers for it, 80% of all phone numbers in their systems are already mobile numbers.)

Since your customers are doing you a favor by letting you tap into their thought process, make sure you use a channel that respects their preferences and even better, enhances the customer experience.

So what's the right call?

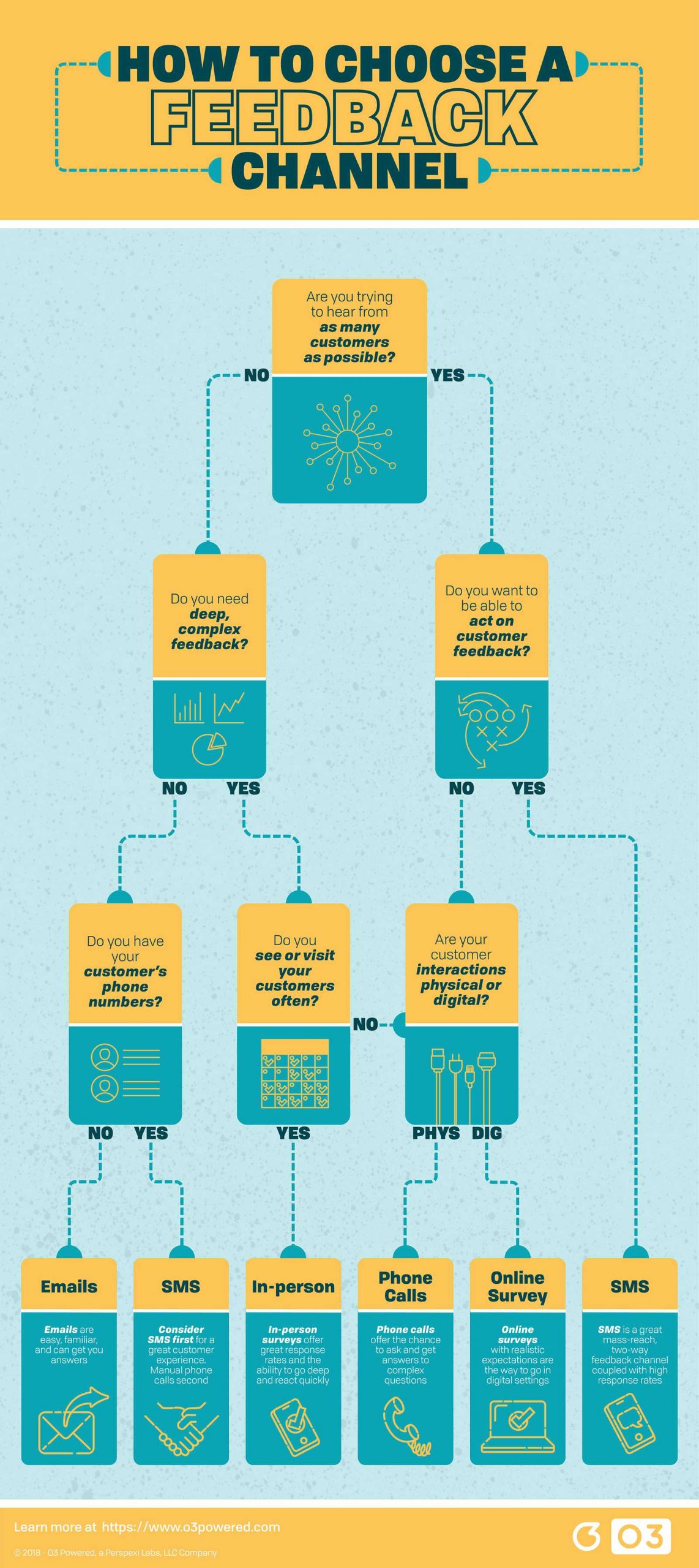

The answer is, of course, it depends! The right call depends on your circumstances and the factors that are important to you. We’ve covered a lot of ground here, but we broke down the factors and channels into a handy little flowchart to help you figure it out:

Here at O3 we’re of course a little biased: we think that gathering customer feedback via SMS is incredibly effective, inexpensive, and the perfect way to continue the conversation. The response rate for text messages is almost double that of its next closest competitor, phone calls, but can be accomplished on a much larger scale, allowing you to hear from many more of your customers. And if something needs to be done, you can either text back or call right away, closing the loop.

Of course you’ll want to keep your surveys short, but that’s general good advice under most circumstances anyway. If you’d like to see your response rates skyrocket with little extra effort on your part, you should try out our Outreach tool.

[1] Email is a little tricky to pin down a single source on. It is important to differentiate between email open rates (usually 20-55%), and click-through rates, which would indicate a survey start. Click-through rates are seen as being anywhere from 2% to 25-30%. The most common statistic we have seen, however, is in the single digits, hovering around 6%.

[2] Online: https://www.apptentive.com/blog/2016/10/04/mobile-survey-response-rates/

[3] Phone call: http://fluidsurveys.com/university/response-rate-statistics-online-surveys-aiming/

[4] SMS: We’ve sent hundreds of thousands of surveys, and this is the average response rate across all our customers.

[5] In-person: https://www.fieldboom.com/blog/survey-response-rate/

Want to learn more about O3’s offerings? Check out what you could be doing in your business today, and request a free demo.